OVERVIEW

Pre-Election Budget:

The Federal Treasurer has allocated a Budget for 2022-23, with an emphasis on cost-of-living relief, job creation and skills development. The fiscal deficit is estimated at $78 billion (down from $98.9 billion estimated just three months ago), or 3.4% of GDP.

Fourth Frydenberg budget benefits from improving commodity prices and tax collection combined with record-low unemployment and significantly reduced welfare bill to achieve improved bottom line margins – over the next 5 years estimated $103.6 billion higher than the previous year. The government is trying to find a balance between compensating consumers and fueling inflationary pressures in an economy that is already facing business activity.

Compensate for inflation:

To compensate businesses and families for higher operating and living costs, the Budget includes a temporary and targeted cost of living package:

– Fuel consumption is cut in half in 6 months estimated to save 22.1 cents/liter.

– The $420 living tax expense offsets more than 10 million low- and middle-income people, boosting consumer spending.

– A one-time $250 Cost of Living payment for retirees, carers, veterans, job seekers, eligible self-financed retirees and priority audiences.

Small business productivity and security:

To increase investment in new skills and technologies, the government announced:

$120 tax deduction for every $100 spent on employee training.

A $120 tax deduction for every $100 spent on digital technologies like cloud computing, e-invoicing, cybersecurity, and web design.

Investment support up to $100,000 per year.

Infrastructure projects:

The budget includes $17.9 billion in new infrastructure projects nationwide, including seven priority gas infrastructure projects. NSW collects $1 billion contribution for Sydney to Newcastle rail upgrade.

Support for flood-affected communities:

Total assistance to families, small businesses, local governments and local communities exceeds $6 billion.

Defense and National Security:

Prioritized and enhanced with a $270 billion defense capabilities plan supporting 100,000 jobs and a new 10-year $9.9 billion investment in Australia’s cyber defense and attack capabilities.

Policy Reforms:

With an election due within weeks, this is a steady budget that aims to support demand in the economy without fueling inflation. Much needed tax reform, fiscal policy adjustment or Federal reform will have to wait for the next budget and the next term of the Australian Parliament. This is a budget that supports economic recovery, avoids austerity while declaring emergency measures are over, and remains cautious when it comes to reforms.

FINANCIAL AND ECONOMIC PROSPECTS

Economic prospects:

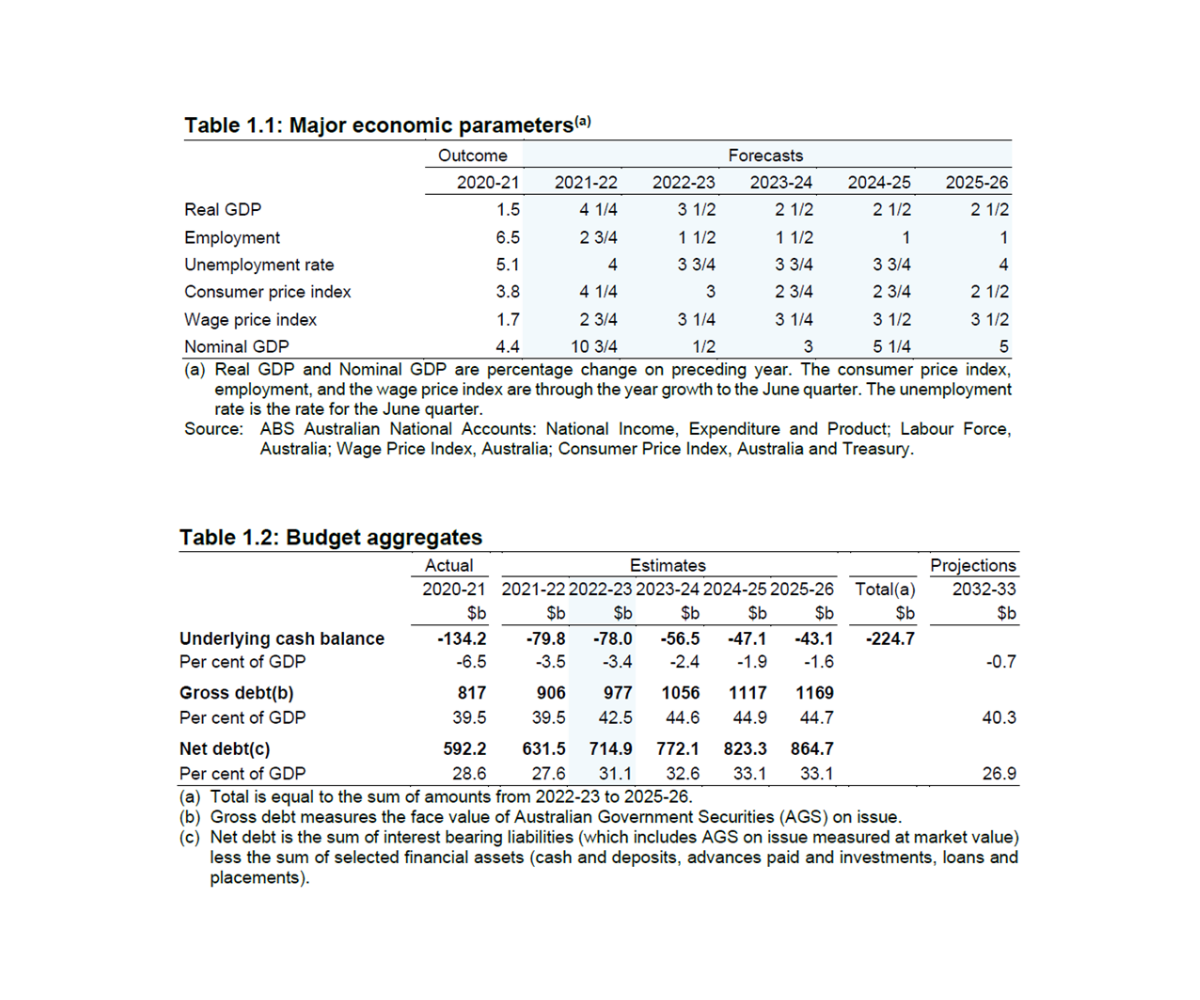

The Australian economy is forecast to grow by 3.5% between 2022-23, down from an estimate of 4.25% for 2021-22. Economic growth is expected to remain below the previous 3% forecast until 2025-26.

Inflation concerns:

Given the recent rise in global commodity prices (especially oil), inflation is forecast to peak at 4.25% in 2021-22 and average down to 3% in 2022-23 and 2,75% by 2023-24, respectively.

Employment:

The unemployment rate hit a low of 4.0% in February 2022 with a record high participation rate of 66.4%. This number is expected to decrease further to 3.75% by 2022-23. Wage growth is forecast to stay at 3.25% in 2022-23 and remain at that level in 2023-24.

Debt and deficit:

The fiscal deficit is estimated to be $78 billion (3.4% of GDP) in 2022-23 before improving to $43.1 billion (1.6% of GDP) in 2025-26. Net debt is estimated at 27.6% of GDP as of June 30, 2022 (down from the actual figure of 28.6% as of June 30, 2021), peaking at 33.1% in 2024-25 before dropping to 26.9 in 2032-33

ATTENTION POINTS FOR BUSINESS

Temporarily reduce fuel consumption:

To ease the pressure on drivers at petrol stations, the government will cut fuel consumption in half – or 22.1 cents per liter over six months. Prices at suppliers are likely to remain elevated from levels seen before the Ukraine war began.

Support for businesses:

Turning research into business initiatives: The budget includes a $2.2 billion package to support the commercialization of university research in clean energy, health products, defense and other high-priority manufacturing sectors.

Small business support:

A $1.85 billion cash flow relief will be provided to small businesses private companies. The average business will benefit about $800.

$5.5 million to set up a dedicated small business unit in the Fair Work Commission.

Make sure small business owners have access to support. $4.6 million to expand Beyond Blue’s NewAccess program for Small Business Owners and $2.1 million to the Australian financial advisor’s small business debt helpline.

$8 million for the Australian Small Business and Family Business Ombudsman to work with service providers to come up with a business plan, build capacity and financial literacy.

Productivity and security of small businesses:

To increase investment in new skills and technologies, the government announced:

– $120 tax deduction for every $100 spent on employee training.

– $120 tax deduction for every $100 spent on digital technologies like cloud computing, e-invoicing, cybersecurity, and web design.

– Investment support up to $100,000 per year.

Introducing ‘Promoting Technology Investment’:

$1 billion to help small businesses grow digitally. Small businesses with less than $50 million in annual revenue will have access to a new bonus of a 20% deduction for the cost and depreciation of assets that support digital use – up to $100,000 in spend per year. year.

– Instant asset write-off: maintained until June 30, 2023.

– Strengthening Sovereign Manufacturing Capacity: The government is investing an additional $328.3 million in the Modern Manufacturing Strategy.

– Expanded patent box tax incentives to help manufacturers turn good ideas into commercial results and SMEs to innovate and adopt new technologies.

Regional internet service:

Government will spend $480 million to upgrade regional internet services, allowing up to one million businesses and households in remote areas to access fixed wireless services for internet speeds faster. This bodes well for local businesses.

Spending by specific areas:

– Defense – Amid recent geopolitical tensions, defense recruitment is set to increase and a nuclear-powered submarine base will be established on Australia’s east coast. Defense will be prioritized and enhanced with a $270 billion defense capabilities plan supporting 100,000 jobs and $9.9 billion in new 10-year investment in space attack and defense capabilities Australian network.

– Environment – In an effort to reduce emissions, the government has budgeted $100 million in tax incentives for farmers to sell carbon credits and biodiversity certificates.

Flood relief for affected local businesses and communities:

Total assistance to families, small businesses, local governments and local communities amounts up to more than $6 billion.

Jobs and skills:

Apprentices and interns: The Australian Government has provided an additional $365 million to extend the Successful Apprenticeship Enhancement (BAC) wage subsidy, which will initially end on March 31, 2022, for three another month until June 30, 2022. It is expected that an additional 35,000 apprentices and interns will be supported under the expansion program.

– From July 2022, a new apprenticeship incentive system: Apprentices and interns in priority occupations will receive direct payments of up to $5,000 over two years, and employers can may be eligible for a wage subsidy of up to $15,000. After a real growth in apprentices through the pandemic, the new system only targets priority occupations.

Highly skilled employees: Businesses with an annual turnover of less than $50 million will receive a new bonus that is a 20% deduction for the cost of external training courses by registered providers in Australia. offer to their employees.

Supplemental funding for skills development:

There is a $3.7 billion increase in funding for the VET sector (pending agreements with states and territories) and expansion of the Transition to Work employment service, introduction of a pre-employment program ‘ReBoot’ to provide mentoring and learning experiences for young people, and subsidized training for those who want to work in aged care.

International borders and migration: The budget predicts positive net migration into Australia. The number of permanent migrants will remain at 160,000.

Support for the workforce:

Pandemic and flu season preparedness: The government will spend $2 billion on booster shots and flu vaccines to slow COVID infections and prepare for the first major flu season in three years.

Cost of living:

To ease pressure on rising cost of living, the government announced a one-time cost-of-living tax offset of $420 for more than 10 million low- and middle-income people, boosting consumer spending. and $250 Cost of Living Payments for retirees, carers, veterans, job seekers, self-financed eligible retirees and other priority audiences.

Childcare and daycare: Childcare subsidies will be increased and put into effect, and more children will be in kindergarten 15 hours a week.

House:

This year’s

Highlights in NSW

Additional funding for road and rail projects has been included to supplement the existing capital program. These projects will generally improve travel times, comfort and reduce existing bottlenecks when completed. Sydney Airport – Western Sydney will validate the public transport needs of the new airport.

Newly funded main projects:

– $1 billion for rail upgrade from Sydney to Newcastle (Tuggerah to Wyong)

– $336 million for Pacific Highway upgrade at Wyong Town Center

– $264 million for Newell Freeway upgrade – heavy pavement upgrade in North Moree

– $232.5 million for Phase 2 Mulgoa Road Glenmore Road to Jeanette Street, Phase 5A Blaikie Street to Jamison Road and Phase 5B Jamison Road to Union Street

– $100 million for the southern link, Jindabyne

– $95.6 million for Picton Bypass and Picton Road – Planning

– $77.5 million for Phase 2 of the Sydney Underground – Western Sydney Airport

Additional funding for existing projects:

– $352 million for Milton Ulladulla Bypass

– $300 million for Line Interface

– $65 million for the M5 Freeway Upgrade – Moorebank Avenue – Hume intersection

Source: Federal Budget